TruSight conducted its quarterly survey to gather investor sentiment on the start of 2022.

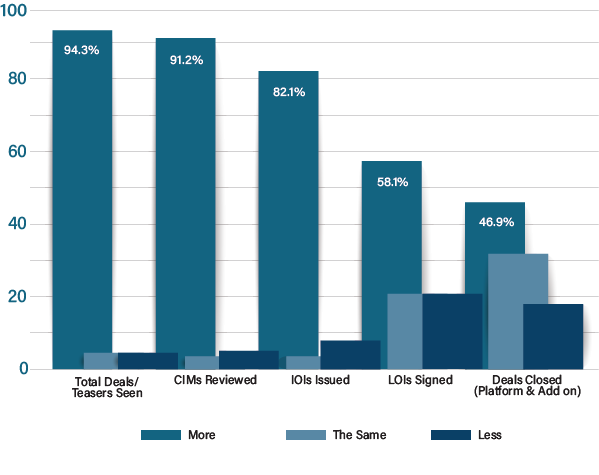

Question one honed in on deal flow changes from first quarter 2021 to 2022.

What a difference a quarter can make. Our 4th quarter 2021 survey showed that nearly 92% of respondents saw more deal flow, and 47% reported closing more deals when compared to the prior year. Four months later, just 33% are reporting seeing more deal flow and just 17% are reporting closing more deals when compared to Q1 2021 [link to Q4 survey].

We suspect this deceleration of growth at the top of the funnel indicates the backlog of deals not done in 2020 and early 2021 is beginning to abate, and we are heading toward a period of historically normalized deal flow. Through our daily conversations with investors, emphasis on in-person management meetings are again become a substantial diligence and investment thesis activity.

Although video conferences make life easier to see more at the top of the funnel, it appears that in order to get all the way through, in person meetings will again be a substantial part of the process.

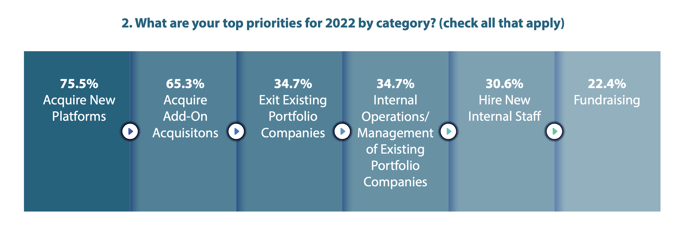

Question two asked funds about their primary objectives for 2022.

With fundraising having been very active, most of our respondents are reporting to be in the “buy mode”, with those acquiring new platforms (76%) and add-ons (65%) as the top priorities for 2022. Given the funnel metrics depicted in question 1, the conundrum remains: how to find relevant investment opportunities at the right time, and at an investable price (we aim to answer this in the following question).

In addition, with a strong M&A market it seems surprising that only 34.7% of respondents stated exiting as a top priority.

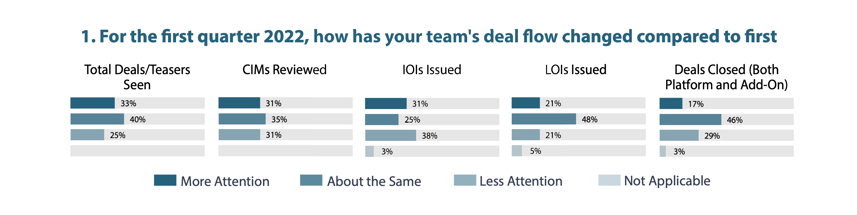

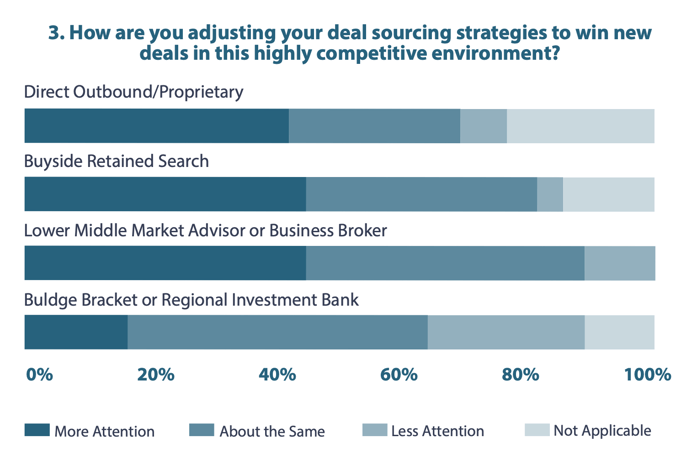

Question three sought insight around deal sourcing strategies in the current M&A Market.

Results showed that private equity has plans to pay more attention to smaller boutique banks and spend additional time on direct outbound strategies as they broaden outreach efforts beyond the larger, bulge bracket banks whom they likely know well and feel they have adequate coverage from.

Services such as TruSight’s Investment Banker Coverage offering are likely to see expanding interest.

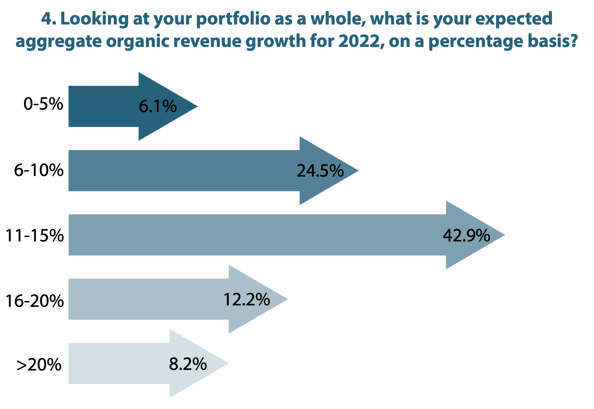

Question four asked participants to estimate their total portfolio’s expected 2022 organic revenue growth.

Over 42% of respondents expect to see an 11-15% aggregate organic revenue growth rate of their portfolio companies.

With looming pricing pressures, supply chain woes, inflation, and general economic uncertainty, this Q1 survey result appears to be optimistic, with the average respondent expecting 11%+ organic growth across their portfolio. If 8%+ of growth is inflationary, that leaves just ~3% of true organic growth.

Question five asked participants about how they plan to manage and grow portfolio companies.

Respondents noted that their main objectives are to focus on their teams and people issues (including operating in partnership with third party vendors), add-on acquisitions, pricing and costs, and thoughtful metrics and reporting. The tone of their responses was that of cautious optimism, having some anxiety on finding, closing, and integrating bolt on acquisitions to dollar cost average down their buy-in multiple.

It comes as no surprise that add-on acquisitions are a main priority when it comes to maximizing value of a portfolio company, but with company valuations at all-time highs, there is new rigor (also a strategic necessity) to considering the risks of a bad deal or missing out on an opportunity – which have major ramifications in this competitive environment.

It is clear through the results of this question that many private equity firms are moving to adopt more mature business processes, reporting, and compliance.

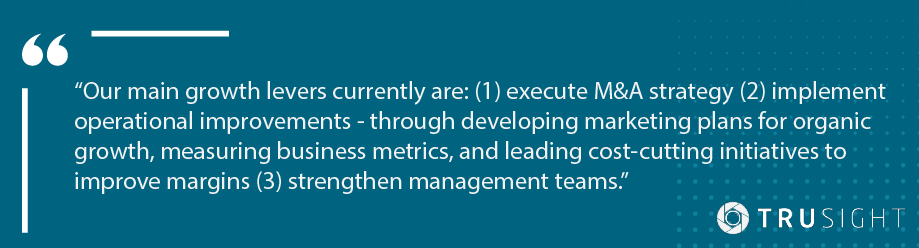

That, coupled with a well-thought-out talent acquisition and management plan, helps firms to protect established brand equity and to continue propel growth. The following quote represents the group: